how to lower property taxes in maryland

Last year roughly 51000 homeowners received an average credit of 1213. At What Age Do You Stop Paying Property Tax In Maryland.

65 of the next 4000 of income.

. The Retirement Tax Reduction Act will eliminate 100 of state retirement taxes in Maryland providing 4 billion in cumulative relief to deserving retirees. Check Your Eligibility Today. One of the most efficient methods is the property tax appeal.

This state-funded program provides over 58 million in needed relief to homeowners who meet the eligibility criteria regardless of age. Additionally eligible homeowners still have to abide by Marylands property. You must apply at least 30 days before your expected settlement date to receive any credit due at the time of settlement.

The Homeowners Property Tax Credit Program Circuit Breaker is the largest and most important program in that it provides annual property tax credits to homeowners who qualify by reason of income. How Can I Reduce My Maryland Property Tax. As part of its program known as property tax credits the State of Maryland provides homeowners with these reductions over a fixed amount of the persons incomeThus any homeowner can limit how much property tax he or she is liable to pay based.

To follow-up on the status of an Offer in Compromise submitted for business tax sales and use tax withholding tax corporate income tax etc please call 410-649-0633 from. When you file the appeal on time you have the right to a mail-in appeal phone hearing or in-person hearing with an assessor. Maryland Property Tax Assessment.

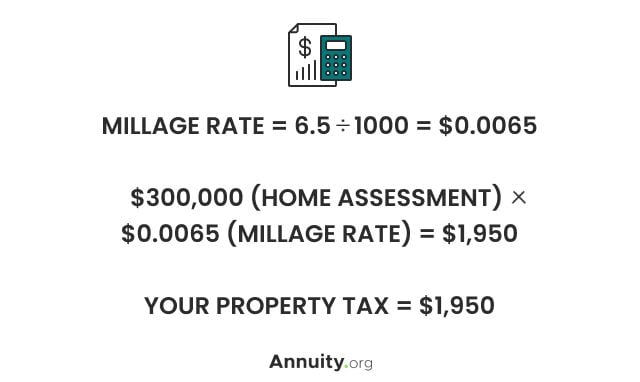

Baltimore County offers a variety of real property tax credits designed to allow property owners to limit their tax exposure and take advantage of savings offered by the County. So if a propertys market value is determined to be 100000 and the assessment ratio is 80 percent the assessed value for property tax purposes would be 80000. In order to come up with your tax bill your tax office multiplies the tax rate by the assessed value.

If your combined household income is. Its calculated at 50 percent of your homes appraised value meaning youre only. The state limits increases to 10 but some city and county governments elect to use a lower limit.

For more information call the Maryland Tax Credits Telephone Service at 410-767-4433 or 1-800-944-7403 or visit the Maryland Tax Credit Programs and Exemption Information page online. The Maryland Department of Assessments and Taxation administers and enforces the property assessment and property tax laws of Maryland. Qualified home purchasers should apply in advance for the Homeowners Tax Credit before acquiring title to the property.

New Yorks senior exemption is also pretty generous. Ad Homeowners Relief Program is Giving 3708 Back to HomeownersCheck Your Eligibility. This detailed report tells you everything you need to know about reduc.

The tax levies are based on property assessments determined by the Maryland Department of Assessments and. Mortgage Relief Program is Giving 3708 Back to Homeowners. Marylands 23 counties Baltimore City and 155 incorporated cities issue property tax bills during July and August each year.

So if your property is assessed at 300000 and. Marylands 23 counties Baltimore City and 155 incorporated cities issue property tax bills during July and August each year. 0 of the first 8000 of the combined household income.

Review the credits below to determine if any can reduce your tax obligation. Learning about actions that can help you reduce property taxes is necessary for every property owner. For more information call the Maryland Tax Credits Telephone Service at 410-767-4433 or 1-800-944-7403 or visit the Maryland Tax Credit Programs and Exemption Information page online.

In Maryland you must file an appeal within 45 days of receiving your new assessment notice. Another important tax credit is the Homeowners Property. This Free Report will show you EXACTLY how to reduce your Property Taxes in Maryland.

However they dont apply to levies and special taxes. Property Tax Credits and Tax Relief. Property tax bills are typically.

Our Baltimore tax attorneys advice clients to have a face-to-face meeting with the assessor as we believe this type of meeting. 4 of the next 4000 of income. You may also review the Baltimore County Code as well as the.

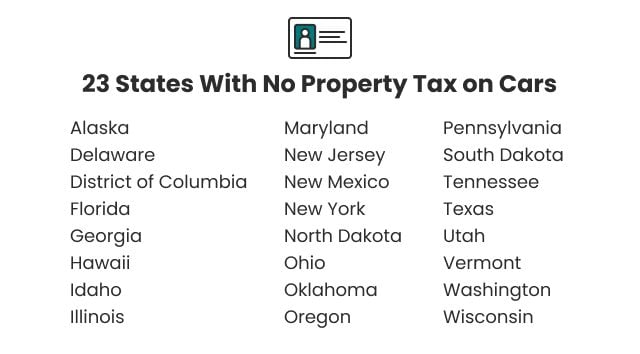

See If You Qualify For Tax Exemptions. And 9 of all income above 16000. Exemptions can reduce the amount of Maryland property taxes.

If you wish to learn how to file a Maryland property tax appeal DoNotPay can help you. The purpose of this program is to help reduce the amount of monies needed at the time of settlement. The tax credit is based upon the amount by which the property taxes exceed a percentage of your income according to the following formula.

Our app also has the scoop on other tricks for tax reduction. To follow-up on the status of an Offer in Compromise submitted for individual income tax please call 410-974-2432 from Central Maryland or 1-888-674-0016 from elsewhere. In past years the governor has been successful in enacting retirement tax relief for law.

Tax relief is phased in over time using an income exclusion and begins in tax year 2022. They include senior and homestead exemptions. Unlike most states where local officials are responsible for property assessment the state government oversees all property assessment in Maryland.

Pin By Cutmytaxes On Property Tax Appeal In 2021 Property Tax Tax Property

Property Taxes By State County Lowest Property Taxes In The Us Mapped

How To Lower Your Property Taxes Youtube

Florida Property Tax H R Block

Property Tax By State Ranking The Lowest To Highest

Pin By Cutmytaxes On Property Tax Appeal In 2021 Property Tax Hb2 Symbols

Personal Property Tax Howard County

Who Pays The Highest Property Taxes Property Tax Denver Real Estate Real Estate Tips

Property Taxes Calculating State Differences How To Pay

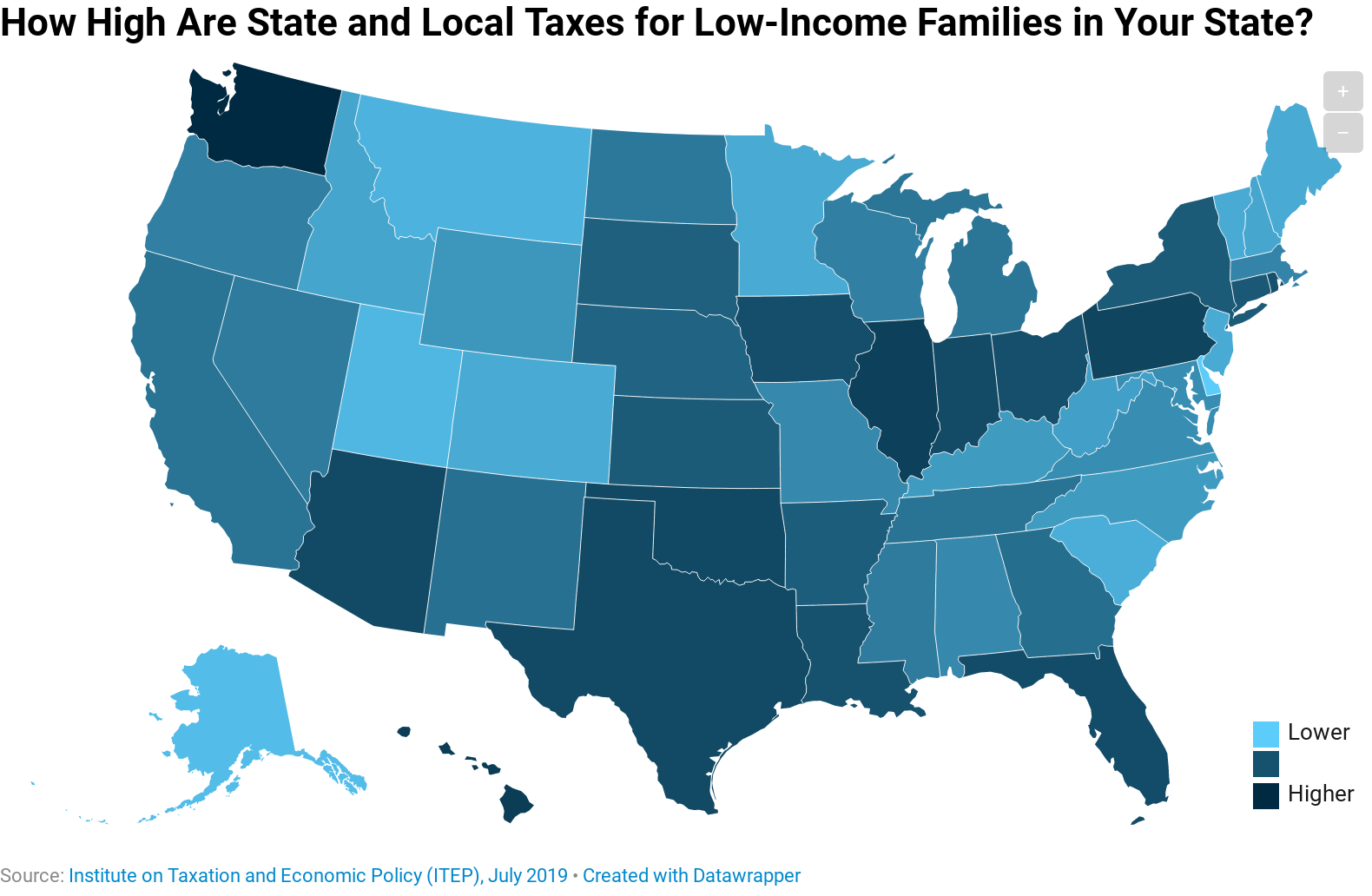

Property Taxes How Much Are They In Different States Across The Us

Deducting Property Taxes H R Block

The Ten Lowest Property Tax Towns In Nj

Property Tax Prorations Case Escrow

How Taxes On Property Owned In Another State Work For 2022

Real Property Tax Howard County

Property Taxes Calculating State Differences How To Pay

Property Tax Appeal Tips To Reduce Your Property Tax Bill

Property Tax Comparison By State For Cross State Businesses

Thinking About Moving These States Have The Lowest Property Taxes